Without involvement, there is no commitment. Mark it down, asterisk it, circle it, underline it. No involvement, no commitment.

—Stephen Covey [1]

Participatory Budgeting

Definition: Participatory Budgeting (PB) is a collaborative process for allocating the portfolio budget to its value streams.

The Enterprise provides a portion of its total budget to each portfolio. In turn, Lean Portfolio Management (LPM) allocates the portfolio Budget to individual Value Streams. The value streams fund the people and resources needed to achieve the current Portfolio Vision and Roadmap. Empowered Agile Release Trains (ART) advance Solutions and implement Epics approved by LPM.

LPM establishes Lean Budget Guardrails to provide the right mix of investments to address both near-term opportunities and long-term strategy. These guardrails also ensure that significant investments are approved and that the appropriate investment level is allocated to technology, infrastructure, and maintenance. These guardrails and KPIs promote decentralized decision-making and execution while providing the necessary oversight.

Details

Participatory budgeting (PB) is a dynamic, collaborative process that enables LPM to gather the data and build the consensus required to invest in the best possible solutions. It’s a critical element of LPM and is used to establish Lean value stream budgets. PB engages a diverse group of business and technical leaders and other stakeholders in the decision-making necessary to establish and adjust value stream budgets on a regular cadence.

Applying PB to establish SAFe Lean budgets has several benefits:

- Allows the portfolio to adjust budgets to support rapidly changing customer and market needs

- Provides leaders with insights and perspectives from multiple stakeholders about existing solutions and proposed epics

- Creates alignment and buy-in on difficult funding choices, improving employee engagement and morale

- Increases ownership of budgets and results in more realistic and achievable budgets than those imposed top-down

- Improves information sharing and knowledge between leaders and teams

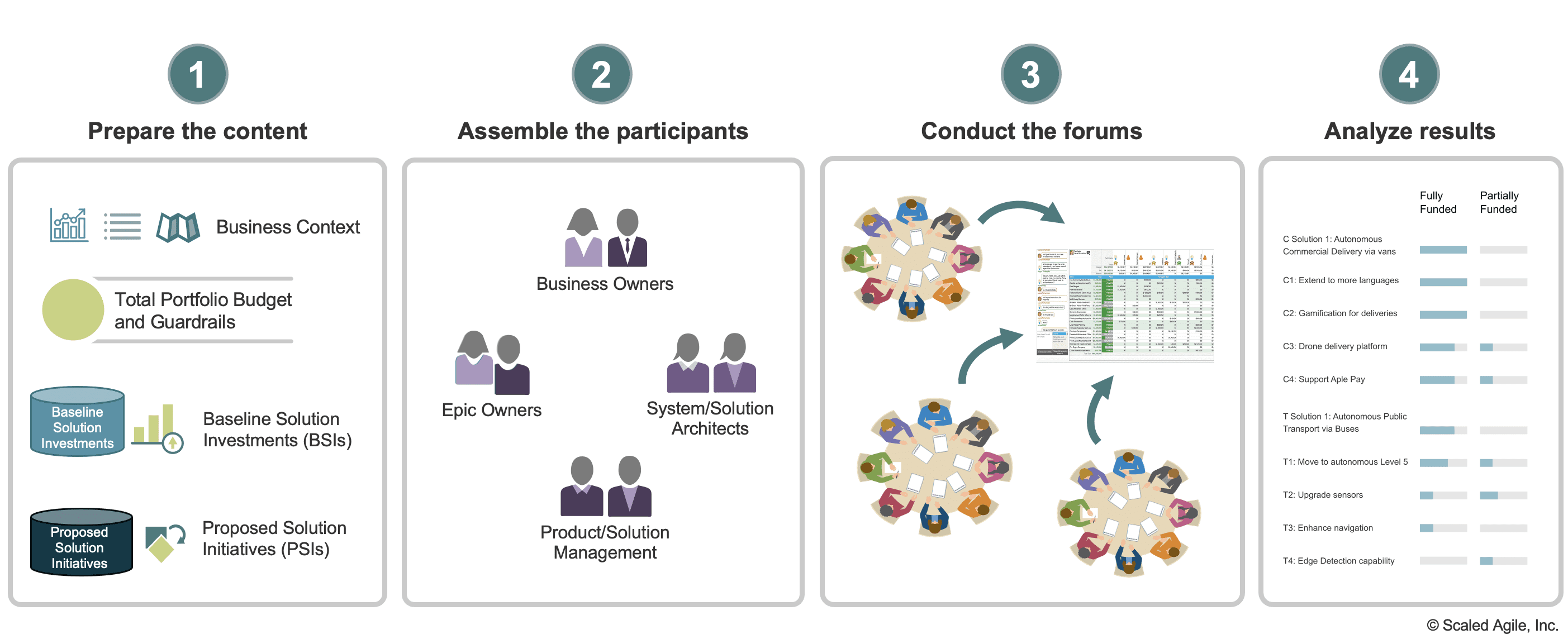

PB is a significant event that requires preparation, coordination, and communication, as illustrated in Figure 1.

This article describes how PB is applied in SAFe using an example loan origination and processing portfolio (Figure 2). Its two development value streams (loan application and core banking) manage four solutions, each developed and maintained by a dedicated ART (Figure 2).

1. Preparing the Content

Business Context

The first step in preparing the content is establishing and sharing the business context. This context typically includes the current state of the business, Strategic Themes, and Portfolio Vision. This information is critical in preparing the investment opportunities to bring into the PB event and guiding the participant’s decisions.

Additional information, such as solution and portfolio roadmaps, can help highlight market rhythms and milestones. In our example, the business faces an economic downturn, and LPM will reduce the total portfolio budget allocated for this period.

Total Portfolio Budget and Guardrails

The total portfolio budget is a critical input to the PB process. It describes the money available to fund the value streams within a portfolio. The Lean budgets and guardrails guide how the value streams spend money and influence the mix of investment opportunities brought into the PB event.

The portfolio in our example is associated with a business facing an economic downturn. Accordingly, the enterprise has reduced the total portfolio budget from 24,000 to 21,000. This decrease will require reducing funding to some of the portfolio’s value streams.

Baseline Solution Investments

Stakeholders need to understand the current investment context to budget responsibly. Each value stream budget has two parts, as illustrated in Figure 3. The first part, Baseline Solution Investments (BSIs), are the costs to develop, support, and operate a solution that delivers current business capabilities. The second part will be described in the following section, Proposed Solution Investments.

BSIs are reviewed during the PB event to ensure existing solutions are funded to meet the business’s needs or identified for decommissioning. This budget includes the cost of ongoing development and maintenance of the solution. In some contexts, these costs may include operations, support, sales, and marketing directly applicable to a specific product or service or allocated to a solution as a percentage of the total portfolio costs.

Typical BSI costs include:

- Employee salary and corporate overhead

- Contractors (such as outsourced development)

- Suppliers (such as solutions used or integrated during development)

- Hardware or other physical materials, licensing, and additional resource costs

- Corporate allocations for shared services

- Other line items required by the portfolio

LPM can determine BSIs using a simple spreadsheet (Figure 4). The ‘% Allocation’ column reflects the percentage of the value stream costs allocated to a specific solution, offering a way to analyze these costs. When an ART creates a single solution, the BSI is straightforward; it’s merely the ART’s cost. When an ART develops more than one, LPM should allocate the value stream costs proportionally to each solution. A portfolio may choose to decompose BSIs into more specific line items to identify potential areas of waste. LPM allocates BSIs for a particular budgeting period (usually twice per year). For example, if the PI cadence is every three months, then a typical budgeting horizon is every two PIs.

Figure 5 illustrates the BSIs for our example portfolio. It shows the annualized solution costs and the costs for the last two PIs and informs the requested budget for the next two PIs’ budgeting period.

Proposed Solution Initiatives

Proposed Solution Initiatives (PSIs) describe significant development initiatives needed to improve current solutions or introduce new ones. These may include:

- Portfolio epics (business or enablers)

- Solution epics (which are above the portfolio epic threshold)

Solution epics below the portfolio epic threshold are captured as BSIs, while those above the threshold are captured as PSIs.

Business agility requires that the portfolio make the best possible investment decisions for both in-progress and new epics (Figure 6). Accordingly, in-progress epics whose remaining costs are above the threshold are included in the PSIs to ensure continued investment is justified, given current market conditions and learning. If new or better opportunities arise, the investment in in-progress epics can be reduced or stopped. Previous investments from a prior budgeting period are sunk costs and ignored by LPM during decision-making.

Establish Budget Time Horizons

Any budgeting process must establish the time horizon of the budgeting period. As noted earlier, value stream budgets are typically updated twice annually (about every two PIs). Since epics typically span PIs, it rarely fits within a specific budgeting period (Figure 7). Accordingly, each PB event should only allocate a portion of the epic’s cost likely to be incurred in the upcoming budgeting period.

For an epic that has not yet started, it generally doesn’t make sense to budget for the entire estimated implementation cost until the MVP hypothesis has been proven. It may or may not be proven; even if it is, some of the planned investment may continue outside the current budget period. As development proceeds, the estimated implementation cost is refined based on learning from the MVP. Accordingly, LPM only budgets the epic’s investment expected to be incurred in the upcoming budget.

For example, ‘epic 2’ spans two budgeting horizons. The first part of the epic will be included in the current PB event, while stakeholders will consider the remaining cost of ‘epic 2’ in the following PB event. Epic 1 fits within the upcoming budgeting period. However, the in-progress Enabler epic will continue into the following PI, and its remaining cost will also be included in the forthcoming budgeting period.

Determine Proportional Epic Costs for Each Value Stream

Epics typically split across value streams, such as the ‘Move to Flutter’ epic, are funded proportionally by the responsible value streams. In our example, this epic’s forecasted cost is 800K. If the core banking solution only requires 200K, then the remaining 600K must be budgeted by the other value stream, which does the rest of that work. The cost allocations for PSIs should be transparent during PB and enable value stream budgets to be calculated following the event, as shown in Figure 8.

2. Assemble the Participants

PB is most effective when diverse and responsible representatives are involved. Each role brings a unique and valuable perspective to the decision-making process. Attendees typically include:

- LPM

- Product and Solution Management

- Epic Owners

- Enterprise and Solution Architects

- Business Owners

- Other relevant stakeholders, such as finance, marketing, or sales

The total number of participants is typically a function of the portfolio’s size. Large portfolios require more participants. Since negotiations often break down with more people, SAFe recommends creating groups of five to eight participants for the PB event. To promote healthy debate and learning, each group should have a mix of roles from different value streams. Our example PB event includes 40 people, organized into five groups of eight people.

3. Conduct the Forums

Standard Agenda

The PB event follows a schedule similar to Figure 9. Descriptions of each item follow.

- Business context – A senior LPM executive or line-of-business owner typically sets the business context for the PB event, including discussing current business performance, revenue or market share, customer satisfaction measures, and more. It often updates operating plans, organizational developments, strategies, and competitive contexts. The presenter will typically discuss strategic themes and business objectives for the upcoming periods, including a review of the portfolio roadmap, when needed.

- Epic and solution briefings – Epic Owners present a brief overview of PSIs, and product management gives an overview of BSIs for each solution and critical market events and milestones.

- Participatory budgeting process – A facilitator presented the PB process and expected outcomes of the event.

- Participatory budgeting forums – Participants are organized into groups of five to eight people with various roles and people from different Value Streams. Each group gets the total portfolio budget equally divided among the participants. Each group debates and collaboratively funds the BSIs and PSIs.

- Moving forward – LPM presents the initial results of participatory budgeting and discusses the next steps.

- Participatory budgeting retrospective – A facilitator leads a brief retrospective for the PB event to capture what went well, what didn’t, and what can be done better next time.

Participating in a Forum

At the start of the PB forums, each group of participants is given the list of BSIs and PSIs and their forecasted costs (Figure 10). At the forum’s start, the group is assigned the total portfolio budget to allocate, and each participant gets an equal portion.

In our example, the total requested budget for all BSIs and epics is 24,900K, exceeding the 21,000K portfolio budget by 3900K. Since the enterprise has already reduced the portfolio’s total budget allocation from 24,000K to 21,000K, surpassing it is not an option. However, LPM could reduce investment in some BSI to ensure funding for the requested epics. Alternatively, the LPM team could stop in-flight epics or defer new epics. However, these complex decisions require expert knowledge and judgment of key business and technology stakeholders. PB’s primary purpose is to get this feedback from key stakeholders and determine how to allocate the budget best.

Since no participant can likely fund BSIs and epics independently, the group must collaborate to pool their money and identify and support the best investments. Generally, the first order of business is to invest in BSIs based on the current business context. In other words, the current BSIs may not meet the needs of the evolving strategy, and these must be analyzed and potentially adjusted.

To fund initiatives, individuals in each group must pool their budgets. Because partially funded solutions and epics are candidates for termination or cutbacks, the group will negotiate to determine where to make the best investments. The discussions from this collaboration allow participants to make choices that optimize value delivery across the portfolio rather than focusing on their value streams.

After funding or adjusting the BSI, teams are encouraged to support their highest-priority epics fully. This guidance avoids spreading too little money across too many initiatives that are not funded sufficiently. Full investment in a selected set of initiatives is the key to a strategy that builds on an enterprise’s strengths and creates viable and differentiated product offerings.

During a forum, a group may:

- Invest more than the estimate if they have reason to believe the costs are too low or if they think it should be delivered sooner or with more value

- Invest less if they have reason to believe the costs are too high or if the investment should be deferred to a future budget period

Figure 11 shows how one group allocated its budget during the PB forum. Highlights include:

- It deferred the introduction of new features in the channel management and loan origination solutions, which reduced the value stream’s BSI

- It fully funded the revenue-generating Facebook login and college student loans

- It reduced the scope of investment in the core banking microservice enabler epic

4. Analyze Results

The aggregated results of the PB forums are analyzed to identify suggested funding patterns. In Figure 12, for example (derived from an actual PB event using SAFe Collaborate), it is easy to see alignment on funding priorities:

While the PB event results do not directly determine the budget allocations for the value streams, they provide critical information and input that LPM needs to make an informed decision that maximizes the portfolio’s business outcomes.

Some common patterns of investment include:

- Investing a consistent amount in one or more solutions that are generating stable returns

- Reducing investments in one solution to invest more in a different solution with a better-projected return

- Investing in the decommissioning of obsolete solutions to free resources for innovation

- Investing across all solutions to realize a standard set of business requirements, such as compliance or serving a new or adjacent market

- Reducing investments across all solutions during an economic downturn

These patterns are not exhaustive, and a specific portfolio’s needs will determine how they manage solutions investments.

Given this input, the LPM team makes final determinations to implement these changes, including:

- Finalizing the portfolio budget

- Allocating funding to value streams

- Verifying that the investments align with the Lean budget guardrails

- Engaging with HR, finance, legal, operations, and any other affected groups

Value streams typically prepare for these changes during the current PI and implement them at the start of the following PI.

Adjusting Value Streams Dynamically within Approved Budgets

After LPM finalizes budgets based on the analysis, the value streams adjust their work dynamically to address current facts, local context, and emerging business results. Some examples may include the following:

- If the epic hypothesis is proven, the value stream will continue to work on the epic, using the allocated budget.

- If it’s not proven, the value stream will stop working on the epic or pivot to a new hypothesis and epic. In the meantime, empowered ARTs pull the next approved epic from the portfolio backlog or the next set of approved work items from the ART backlog.

This dynamic structure is the essence of Lean budgeting and provides a far more Agile way to address budget changes and have the teams work on what matters at that time.

Learn More

[1] Covey, Stephen R. The 7 Habits of Highly Effective People: Powerful Lessons in Personal Change. Simon & Schuster, 2013.Last updated: 6 September 2023